Our performance

Measuring our performance

To create sustainable economic value for our shareholders we focus on delivering growth and cash while maintaining appropriate capital. We aim to demonstrate how we generate profits under different accounting bases, reflecting the returns we generate on capital invested, and highlight the cash generation of our business.

Notes

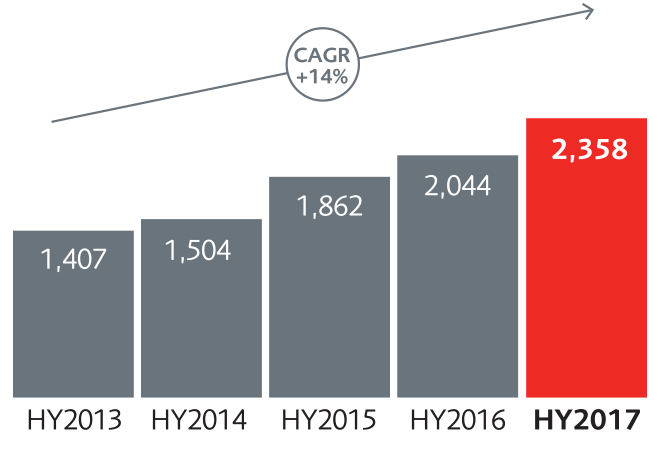

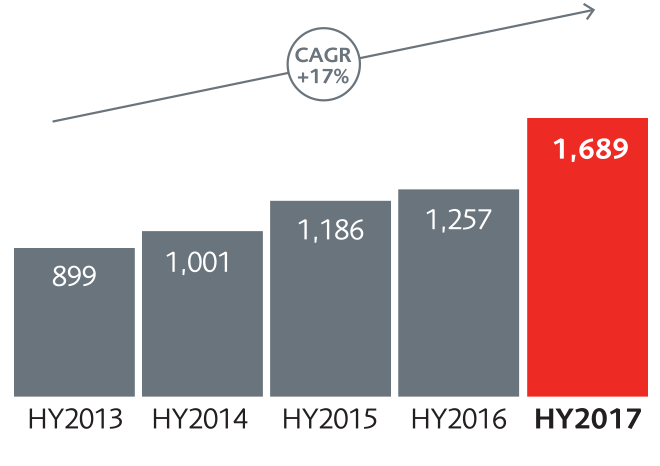

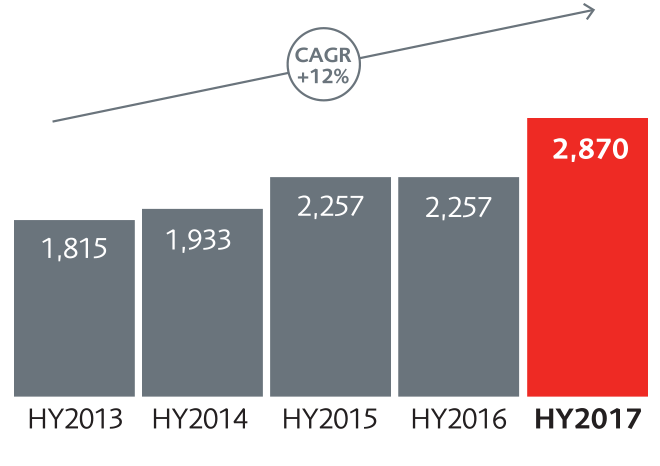

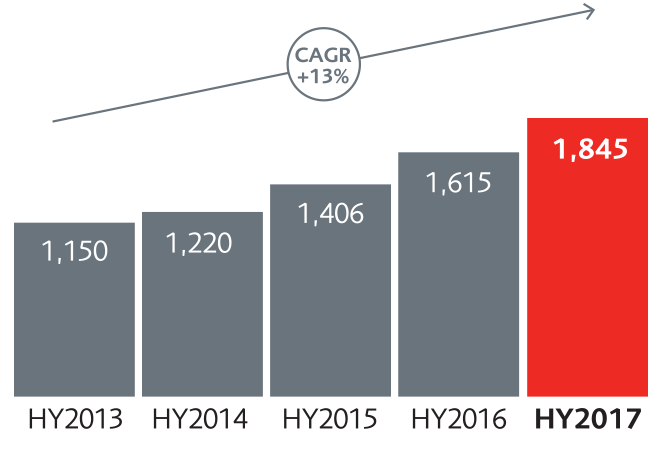

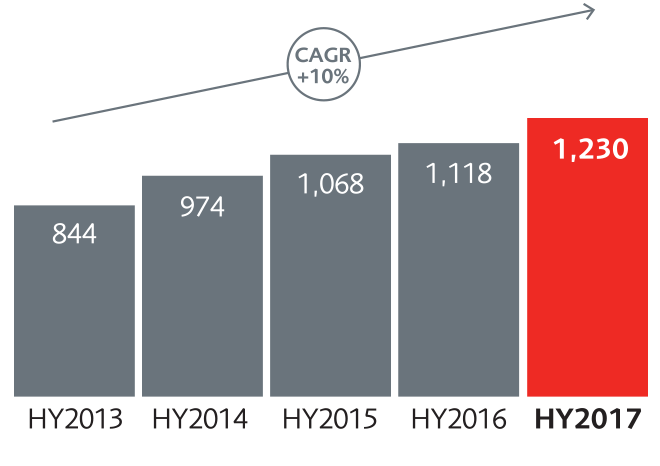

- The comparative results shown above have been prepared using the actual exchange rates (AER) basis except where otherwise stated. Comparative results on a constant exchange rate (CER) basis are also shown in financial tables in the Chief Financial Officer’s report on the 2017 first half financial performance. CAGR is compound annual growth rate.

- IFRS operating profit is management’s primary measure of profitability and provides an underlying operating result based on longer-term investment returns and excludes non-operating items. Further information on its definition and reconciliation to profit for the period is set out in note B1 of the IFRS financial statements.

- Following its sale in May 2017, the operating results exclude the contribution of the Korea life business. All comparative results have been similarly adjusted. The relevant 2017 objective (Asia IFRS operating profit) has been adjusted.

- Embedded value reporting provides investors with a measure of the future profit streams of the Group. The EEV basis results have been prepared in accordance with EEV Principles discussed in note 1 of the EEV basis results. A reconciliation between IFRS and the EEV shareholder funds is included in note II(f) of the Additional financial information.

- Underlying free surplus generated comprises underlying free surplus generated from the Group’s long-term business (net of investment in new business) and that generated from asset management operations. Further information is set out in note 10 of the EEV basis results.

- Cash remitted to the Group forms part of the net cash flows of the holding company. A full holding company cash flow is set out in note II(a) of Additional financial information. This differs from the IFRS consolidated statement of cash flows which includes all cash flows relating to both policyholders and shareholders’ funds. The holding company cash flow is therefore a more meaningful indicator of the Group’s central liquidity.

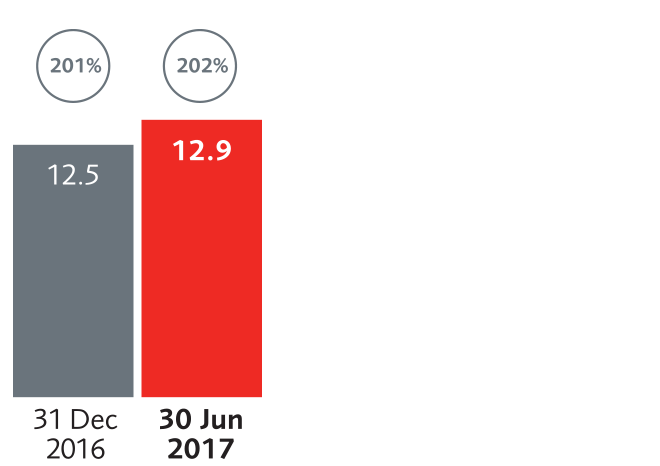

- Estimated before allowing for first interim dividend.

- The objectives assume exchange rate at December 2013 and economic assumptions made by Prudential in calculating EEV basis supplementary information for the half year objectives ended 30 June 2013, and are based on regulatory and solvency regimes applicable across the Group at the time the objectives were set. The objectives assume the existing EEV, IFRS and free surplus methodology at December 2013 will be applicable over the period.

- Constant exchange rates results translated using exchange rates at December 2013.

- The Group shareholder capital position excludes the contribution to own funds and the solvency capital requirement from ring-fenced with-profits funds and staff pension schemes in surplus. The solvency positions include management’s estimate of transitional measures reflecting operating and market conditions at the valuation date. The estimated Group shareholder surplus would increase from £12.9 billion to £13.6 billion at 30 June 2017 if the approved regulatory transitional amount was applied instead.

- Includes UK life insurance and M&G.